Doing the market research for your business plan can be a bit daunting but there are a number of helpful frameworks to support you in this task.

Getting the research right is critical because investors and lenders want to be confident that you know what you are talking about.

Here is some food for thought.

The Product

What type of product are you selling or going to sell?

– is it innovative?

– an adaption of something already there or just a copy?

– have you considered the design and packaging?

– how will you source it?

What thought have you given to:

– acquisition of another provider / supplier

– merger

– make yourself

– buy in

– cost

– quality

– supplier reliability

– capacity

– secrecy

– reputation

Have you considered the product life cycle? Are you ahead of the trend or has your idea already had it?

The market size – a sobering example

What market are you selling into? I had one client, a catering butcher, who told me his market was limitless as he estimated that the UK meat and poultry market to be worth £13.5 billion. It probably is but an analysis of his competitors’ turnover (by pulling their accounts at companies house) valued his part of the market his market at around £200M this was further reduced as he only sold in London because he had no national distribution, his London market was further limited because the national chains would not buy from him and he did not want to sell to the buying groups because it strained the margins too much. From all of this I estimated that his market was actually around £80M and that trying to grow the company from £6M to £12M (7.5% to 15% share) in a market place with no growth was going to be a very hard thing to do.

Screening the opportunities – The Boston Matrix

Have you considered analysing your markets by using The Boston Matrix?

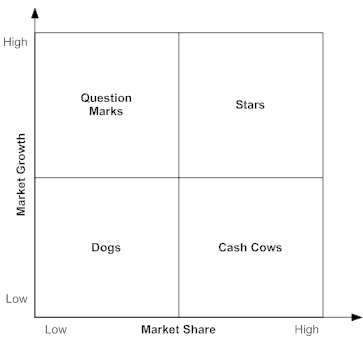

The Boston Matrix

This provides a useful way of screening the opportunities open to you, and helps you think about where you can best allocate your resources to maximize profit in the future.

To understand the Boston Matrix you need to understand how market share and market growth interrelate. Â Market share is the percentage of the total market that is being serviced by your company, measured either in revenue terms or unit volume terms. The higher your market share, the higher the proportion of the market you control.

The Boston Matrix assumes that if you enjoy a high market share you will be making money. (This assumption is based on the idea that you will have been in the market long enough to have learned how to be profitable, and will be enjoying economies of scale that give you an advantage).

The question it asks is, “Should you be investing additional resources into a particular product line just because it is making you money?” The answer is, “not necessarily.”

Dogs:

Low Market Share / Low Market Growth

In these areas, your market presence is weak, so it’s going to take a lot of hard work to get noticed. You won’t enjoy the scale economies of the larger players, so it’s going to be difficult to make a profit. And because market growth is low, it’s going to take a lot of hard work to improve the situation.

Cash Cows:

High Market Share / Low Market Growth

Here, you’re well-established, so it’s easy to get attention and exploit new opportunities. However it’s only worth expending a certain amount of effort, because the market isn’t growing and your opportunities are limited.

Stars:

High Market Share / High Market Growth

Here you’re well-established, and growth is exciting! These are fantastic opportunities, and you should work hard to realize them.

Question Marks (Problem Child):

Low Market Share / High Market Growth

These are the opportunities no one knows what to do with. They aren’t generating much revenue right now because you don’t have a large market share. But, they are in high growth markets so the potential to make money is there.

Question Marks might become Stars and eventual Cash Cows, but they could just as easily absorb effort with little return. These opportunities need serious thought as to whether increased investment is warranted.

Growth Strategies – Anshof’s Matrix

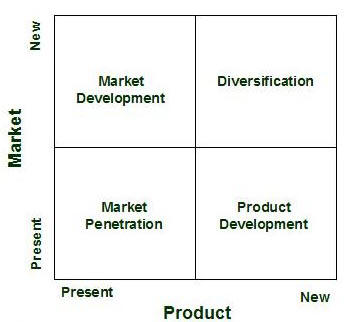

You should also consider Anshof’s Matrix which provides four different growth strategies:

Ansoff's Matrix

Market penetration

Think of it as: relaunch the bike, discount the bike, advertise the bike

This strategy is the least risky since it leverages many of the firm’s existing resources and capabilities. In a growing market, simply maintaining market share will result in growth, and there may exist opportunities to increase market share if competitors reach capacity limits. However, market penetration has limits, and once the market approaches saturation another strategy must be pursued if the firm is to continue to grow.

Market development

Think of it as: export the bike, market the bike via internet

The options include the pursuit of additional market segments or geographical regions. The development of new markets for the product may be a good strategy if the firm’s core competencies are related more to the specific product than to its experience with a specific market segment. Because the firm is expanding into a new market, a market development strategy typically has more risk than a market penetration strategy.

A product development

Think of it as: develop a new range of bikes, build specialist bikes

This strategy may be appropriate if the firm’s strengths are related to its specific customers rather than to the specific product itself. In this situation, it can leverage its strengths by developing a new product targeted to its existing customers. Similar to the case of new market development, new product development carries more risk than simply attempting to increase market share.

Diversification

Think of it as: make exercise bikes, make wheelchairs

The most risky of the four growth strategies since it requires both product and market development and may be outside the core competencies of the firm. In fact, this quadrant of the matrix has been referred to by some as the “suicide cell”. However, diversification may be a reasonable choice if the high risk is compensated by the chance of a high rate of return. Other advantages of diversification include the potential to gain a foothold in an attractive industry and the reduction of overall business portfolio risk.

Price – Relationships with quality and market position

Price is obviously a key factor but the important connection here is its relationship with quality and market position, not how cheap it is, or it costs less than the competition. Obviously you need to be competitive and whilst a buyer always puts price at the top of the list, it usually is around number 5. Think of yourself, do you only concentrate on price when buying or are there other factors? Also consider pricing for different markets, the consumer market might pay more than the education market, tweak the product to meet the market.

Margin and distribution channels also go hand in hand and whilst you have a required margin, you may consider split margins with a distributor.

If we look at pricing there are hundreds of ways to arrive at a selling price:

– Cost related; standard cost, cost plus profit, break even or marginal pricing.

– Marketed related; perceived value, psychological pricing, promotional pricing, skimming (riding down the demand curve).

– Competitor related; discount related, penetration related, dumping.

The important thing is to maximise the price you can get from any one situation and not stick doggedly to the pricelist.

Promotion & Distribution

This is all about considering how you are going to communicate with your customers; sales force, advertising, (if so what media – including internet presence and social media), Exhibitions, PR.

What are your distribution channels going to be? What level of customer service are you going to give?

What are the costs going to be?

Well, as you can see there is a lot to think about when it comes to marketing and you need to strike a balance. Obviously not all of this needs to be in your business plan. Something above will be relevant and should be thought through for your plan. By demonstrating that you have given it serious thought potential investors or lenders will be more confident about wanting to find out more about you and your business ideas.